A Global Deal for Our Pandemic Age

Report of the G20 High Level Independent Panel on Financing the Global Commons for Pandemic Preparedness and Response

Report of the G20 High Level Independent Panel on Financing the Global Commons for Pandemic Preparedness and Response

The International Finance Facility for Education (IFFEd) Model and Pandemic PPR Financing

The IFFEd, an independent non-profit legal entity set up in 2020, aims to expand Multilateral Development Bank (MDB) lending capacity for education by strengthening MDB balance sheets through the use of portfolio support as well as grants to make these loans more concessional.

In the IFFEd model, a combination of paid-in grants as capital and guarantees by donors can provide development institutions, including MDBs, RDBs, or single-purpose credit facilities, with quasi-equity that they in turn can leverage on capital markets. This leveraging would depend on the capital requirements of each institution and the IFFEd’s credit rating. The financial efficiency of IFFEd also depends on the additional leveraging that comes from the treatment of donor guarantees as paid-in capital in IFFEd’s balance sheet. Under this model, additional grants can also be deployed ‘pari passu’ with the loan to make the terms of the finance more concessional.

Using the parameters developed for IFFEd – that have been reviewed and assured by credit-rating agencies – the proposed vehicle would require from donors commitments of 15 per cent in cash and 85 per cent in contingent commitments (guarantees) for every US$1 dollar of portfolio insurance. In turn, consultations with four large MDBs indicated that they would leverage this portfolio insurance four times if IFFEd was rated very strongly. Thus, for every 15 cents of cash, the vehicle would produce US$4 of financial support to clients, resulting in an overall leverage rate of 27 times.

Cost Calculations for Applying the IFFEd Model to Pandemic Prevention and Preparedness

Although the IFFEd financing instrument was developed to increase education lending, its design can also be applied to vaccines, pandemic preparedness, or other global public health goods as long as the institutions have a strong credit rating and preferred creditor treatment with the capacity to manage these donor commitments and loans.

The governance of any IFFEd-type vehicle for pandemic prevention and preparedness would rely as much as possible on existing arrangements and accountabilities. Donors would fund the paid-in capital and guarantees required, the vehicle’s independent board and contributors would decide on the magnitude and timing of the portfolio insurance to the MDBs, and the MDBs would make lending decisions.

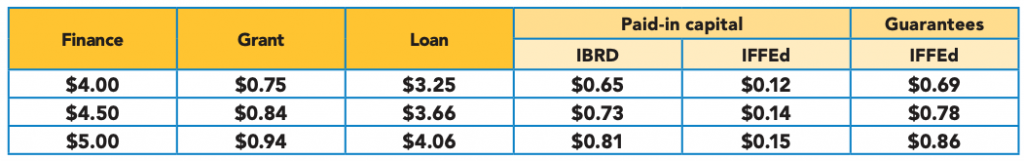

As an illustration, to provide an extra US$4.5 billion annually in financing to Middle-Income Countries (MICs) by the World Bank’s IBRD with the same grant element or concession equal to IDA-regular terms through a combination of a loan and a grant, would require an annual grant inflow of US$1.57billion if this was done by using a standard capital increase mechanism and grants to recipients in conjunction with the loan to increase the grant element.

This annual grant inflow from donors would be split between an increase in paid-in capital of US$0.73billion (20 percent of the US$3.66billion IBRD loan) and US$0.84billion for the grant to the recipient to bring the total finance provided to IDA terms.

With the IFFEd model, in comparison, the same increase in lending would require an annual grant inflow of US$0.98billion split between paid-in capital of US$0.14billion (accompanied by guarantees of US$0.78billion) to support the loan, and the same grant of US$0.84billion to recipients. Additional illustrative calculations are presented in the table below:

Financing IBRD countries (Group B) with a grant element equal to IDA-regular

The portfolio insurance provided by the IFFEd to the institution executing the loans, as noted above, is backed by cash or paid-in capital provided through donor grants. These donor grants could be provided by sovereigns or ‘Public’ actors but this financing instrument could also work with grants from Private actors.

While the use of guarantees as quasi-equity is financially attractive, it is important to note that these guarantees must fulfill key necessary properties. The technical requirements under the IFFEd model are: